During my time at TheStreet over the past nine years, I have spent most of my time tracking individual stocks.

That was the job description from Jim Cramer, who hired me. I was expected to write six to eight updates a day, five days a week. By my calculations, I have written about 18,000 updates on individual stocks and some ETFs over the past nine years. Many of my predictions were successful thanks to a bull market, but some I’d rather forget.

I ignored recommendations for short selling, penny stocks, most things from the cryptocurrency world, options, and anything I didn’t understand.

It is important to know what you are good at and what you are not.

From time to time I have worked on forecasts for the broad market averages, interest rates, the dollar and energy prices. These forecasts require a lot of time and thought. Some of my forecasts have been spot on, others have misjudged the strength of the markets.

Does this remind you of yogiism?

I tried to speak in a clear voice and not to speak with two hands – “on the one hand… but on the other hand…” I apologize to any economists reading this.

How might the markets develop in the coming months? Let’s take one last look.

The loss of dollar hegemony

Let’s start by looking at the dollar index. Most people believe that the US dollar The reserve currency. I don’t think that’s the case anymore, and I think that’s going to have a big impact on the future.

In this daily bar chart of the dollar index below, I can see a bearish setup. Prices have been rolling lower since the beginning of 2024. The dollar index is trading below the falling 50-day average line and below the falling 200-day average line. The 50-day line recently broke below the 200-day line for a bearish dead or death cross. A dead cross is obviously a late signal. I don’t see a bullish divergence from the 12-day momentum indicators, so I don’t expect a counter-trend rally. If the dollar starts a long-term decline, it can mean higher commodity prices (think crude oil) and potentially higher interest on our debt.

In this weekly Japanese candlestick chart of the dollar index below, I can see the price action over the past five years. The dollar had a huge rally in 2021 and 2022. Then prices reached a peak – let’s call it an inverted V-top pattern – and continued to fall. Prices have been trending sideways for the past 18 months and the slope of the 40-week average line has turned negative. The positive price momentum has faded over the past year and I think it indicates an impending decline.

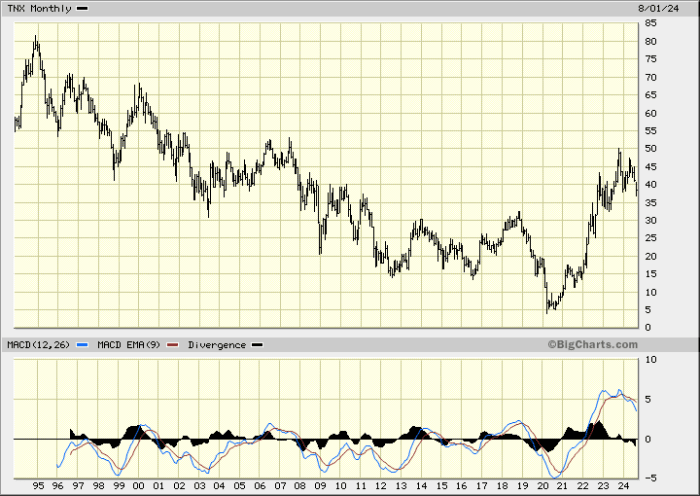

A new multi-year uptrend in yields

Next on my checklist is the 10-year Treasury yield.

In this monthly bar chart of the 10-year Treasury yield below, I can see a long-term downtrend going back to 1994. The downtrend in yields actually goes back to 1981, but this charting service could only show the last 30 years. The long-term downtrend in yields was broken in 2022, and now we are in a longer-term trend of higher yields. We may see a drop in yields over the next few months, but I view that as a countermove. The big picture is: I expect higher yields for many years to come. In the U.S., yields rose steadily from 1951 to 1981. A new multi-year uptrend in yields is underway.

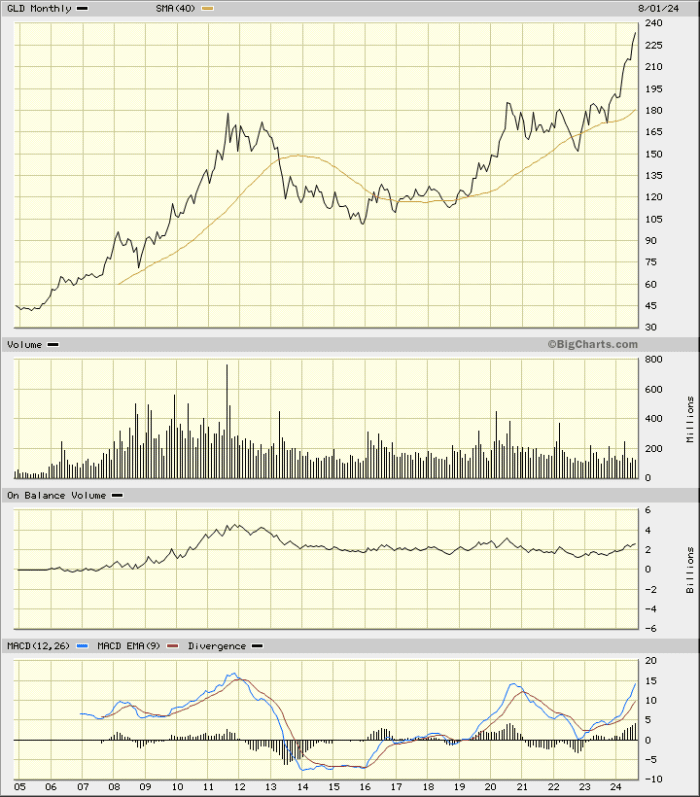

Wind in the sails for gold

In this monthly line chart of the gold ETF GLD, I can see the long-term uptrend. Gold has reached a new all-time high and public participation is, I suspect, very low. Financial advisors are now more likely to recommend some investment in Bitcoin than in precious metals. In my opinion, precious metals still have a long way to go before they are “over-owned” by the private population. The weakness of the US dollar will be one of the winds in the sails of higher gold prices.

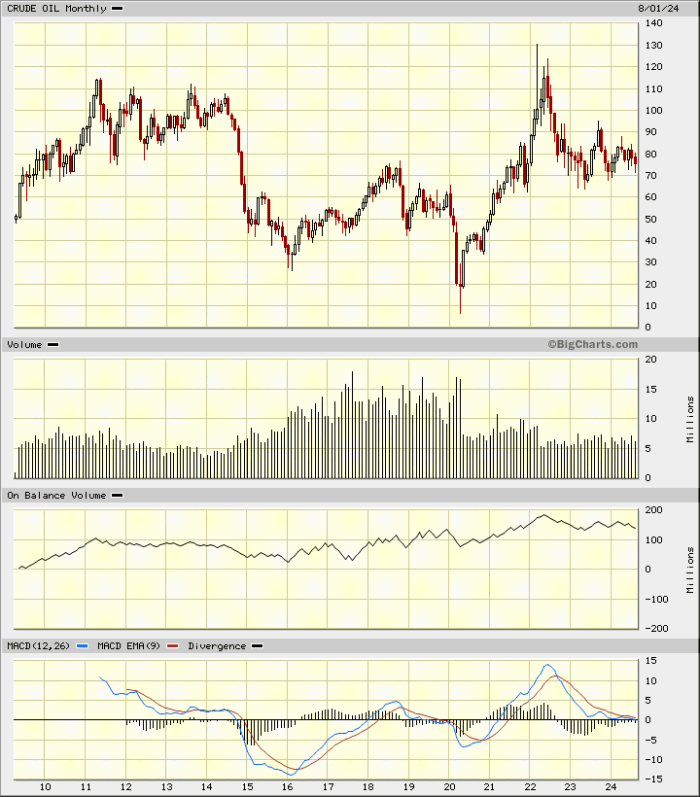

Raw outlook

Crude oil futures have seen some big moves up and down over the years. Over the last 18 months, crude oil prices have formed a large triangle in the chart below. A breakout to the upside or downside could occur from this triangle. Notice I didn’t say “on the other side.”

What about the S&P 500?

And what about the S&P 500? Let’s take a look.

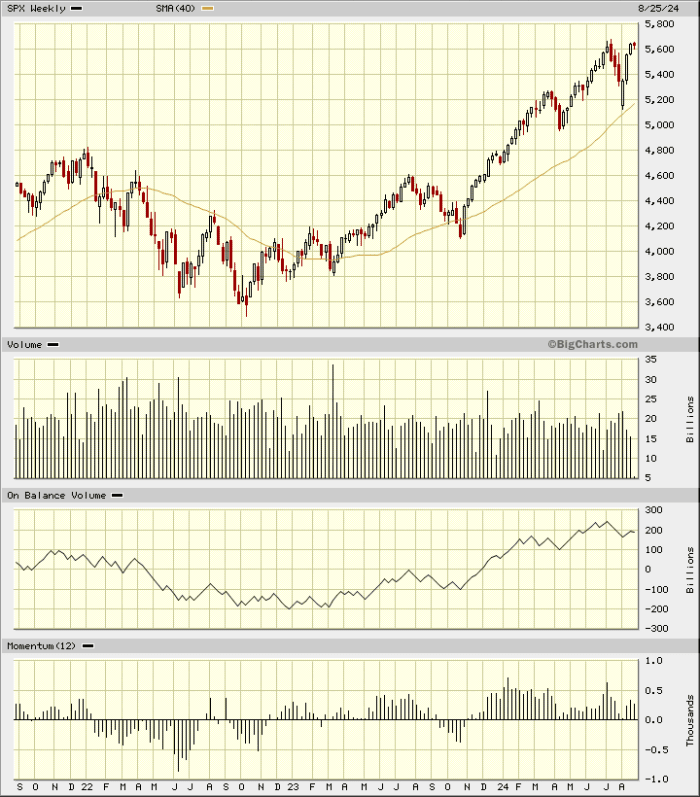

In this weekly Japanese candlestick chart of the S&P 500 below, I can see that prices bottomed out during the pandemic in 2021. The S&P has been trading above the rising 40-week average line for almost two years. The recent weekly candlestick pattern looks like a spinning top right at the previous high at around 5,600. A bearish candle this week could give us a top reversal.

The weekly OBV line has been declining for the past two months. The 12-week momentum study shows a pattern of fading momentum since the start of 2024. This is a significant bearish divergence and could be a harbinger of a serious price decline.

Longtime readers of Kamich’s Korner may remember my candlestick pattern called “eight to ten record highs (or lows).” In the 1990s, Steve Nison and I learned about Japanese candlesticks. Nison did the hard work and shared his findings with me. One pattern he discusses in his books is these eight to ten record highs.

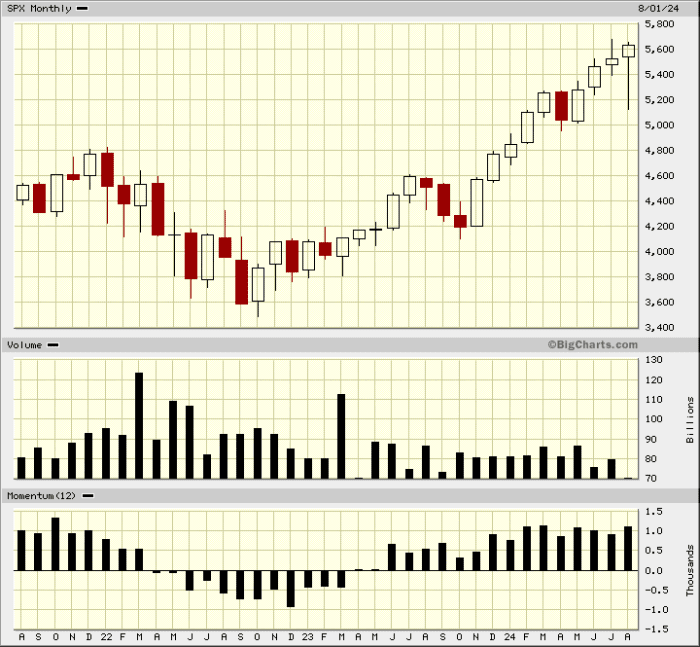

In this monthly Japanese candlestick chart of the S&P 500 below, I can see nine record highs from last October. The most recent monthly candle is a very large hanging man pattern. A bearish candle (red) confirms a top reversal. You can also see that trading volume has declined over the past year’s rally and that price momentum has been flat to bearish. A bearish divergence.

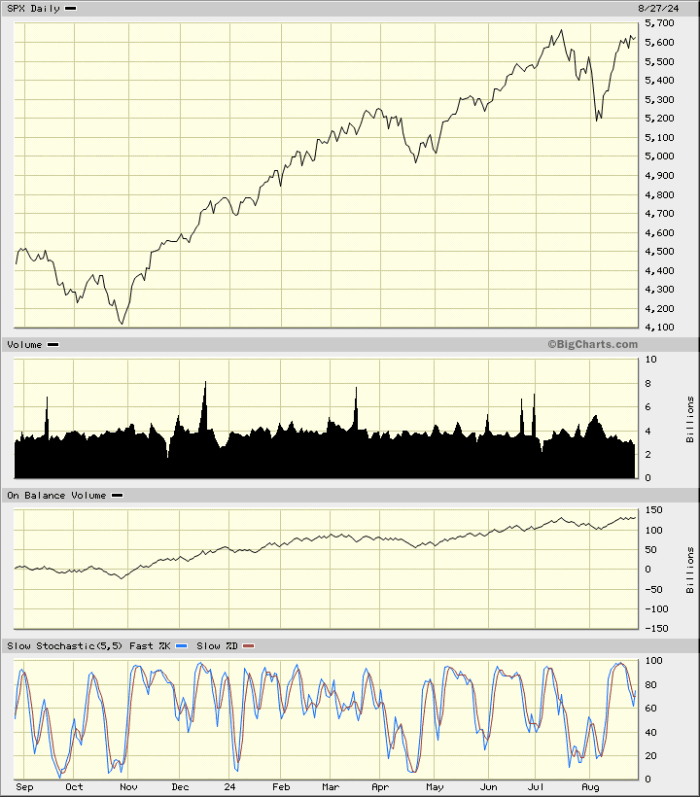

Is the market overbought? Look at this daily line chart of the S&P 500 below. Prices have been making roughly equal highs over the past two months. Look at the slow stochastic indicator, which made a higher high at the second price peak. The market will correct this overbought condition by either moving sideways. or by rejection.

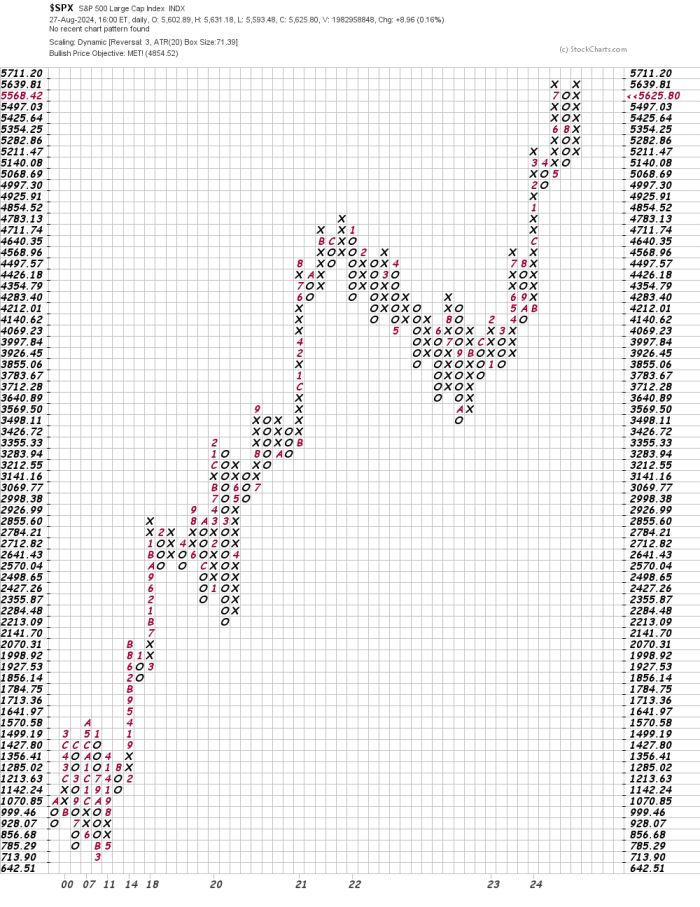

In this daily point and figure chart of the S&P 500 below, I used the Average True Range to organize the price action. Here, the software shows that prices have reached and exceeded the price target of 4,854. Reaching a point and figure price target is not a sufficient reason to sell, but it can be a good reason to take a closer look at the technical situation.

Let’s look at some of the advance-decline lines.

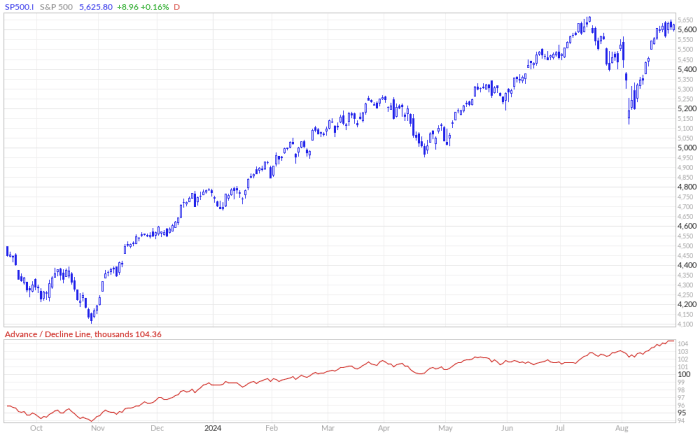

In this S&P 500 daily advance-decline (AD) line below, I can see that the line has risen to a new high. Prices have formed a potential double top pattern. I don’t know all the answers, but one question comes to mind: Why is the AD so strong and prices have not risen to a new high? Please chime in with ideas.

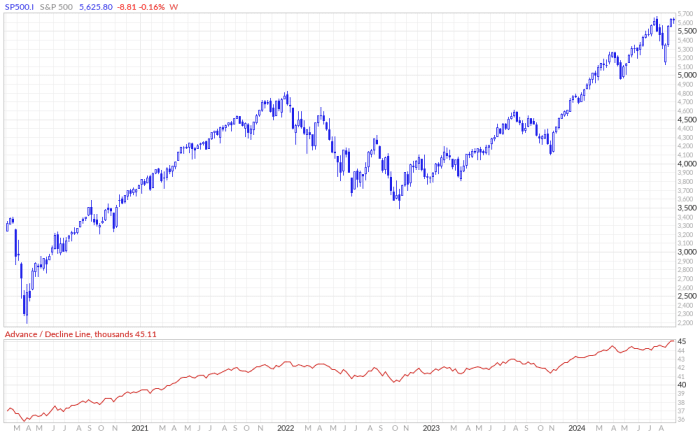

I don’t see any bearish divergence in this S&P 500 weekly AD line below…yet.

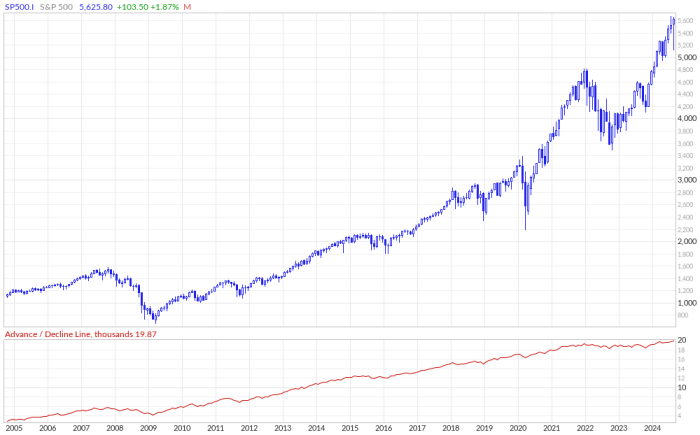

How about a monthly AD line? We have the data, so why not? Here I see a secular bull markett from March 2009. The AD line has been moving higher but has not kept pace with price action over the past year. What’s going on? The S&P 500 is being pushed higher, but only a small list of names? You’ve heard that refrain before.

Bottom-line strategy

Some market experts believe that secular bull markets last 10 to 20 years. According to Ned Davis Research (NDR), the average duration is 1,105 days. However, they also suspect that the current secular bull market could last until 2027. The debate will continue, but remember that averages are just averages. I think now is the time to be cautious and not spend too much money.

TheStreet employees are prohibited from trading in individual securities.